Esmond International Markets Pty Ltd, registered in September 2023, is based in New South Wales, Australia, and offers forex, commodities, and index CFD trading services. However, issues such as false claims about its founding date, weak regulatory backing, and questionable practices severely undermine its credibility. Investors should act cautiously and prioritize the safety of their funds.

1. Company Background Overview

1.1 Discrepancy Between Official Claims and Facts

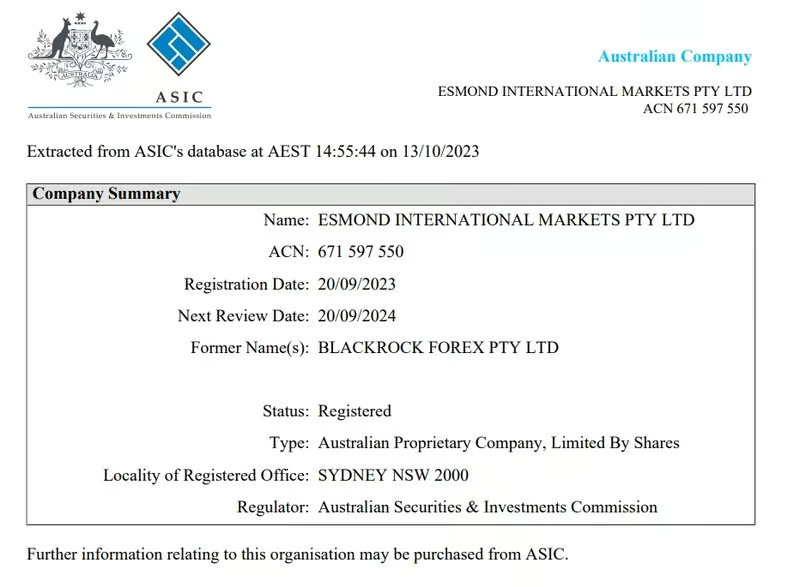

Esmond International Markets Pty Ltd claims to have been established in 2019 and positions itself as an international brokerage offering diverse financial products and CFD trading services. However, according to records from the Australian Securities and Investments Commission (ASIC), Esmond was officially registered on September 2023 with the company number 671 597 550.

Notably, the company lacks an Australian Business Number (ABN), which could restrict its ability to legally conduct business transactions in Australia and raises compliance risks.

1.2 Domain Registration Details

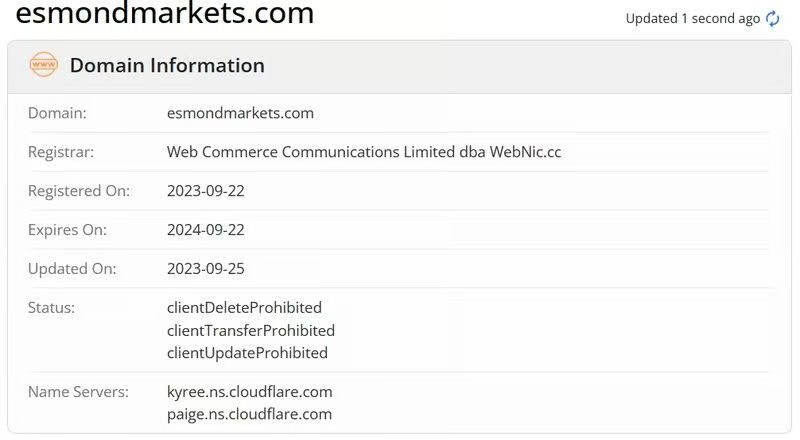

A Whois search reveals that Esmond’s website domain was registered on September 22, 2023, less than a month ago. This fact directly contradicts its claim of being established in 2019, further fueling doubts about its authenticity.

2. Regulatory Information and Licensing

2.1 Weak Licensing Structure

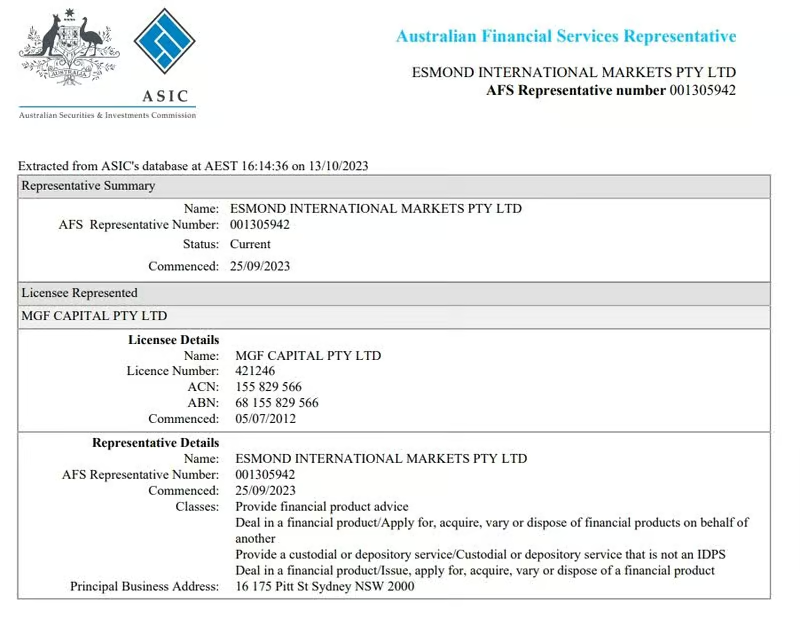

Esmond International Markets Pty Ltd claims to hold an ASIC regulatory certificate under number 001305942. However, upon verification, the company does not hold a full ASIC license but operates as an Authorized Representative (AR) under a license purchased from MGF CAPITAL PTY LTD.

An AR license allows the authorized party to conduct specific financial services under the licensor’s name but offers minimal regulatory oversight and limited investor protection. This model is often exploited by low-cost operators for promotional purposes, concealing the lack of comprehensive regulation.

2.2 Warning Signs of Fraudulent Practices

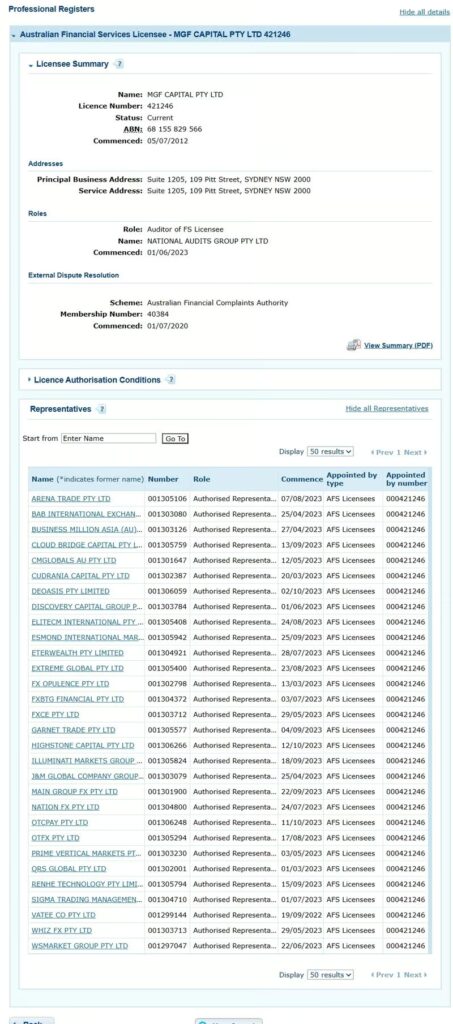

MGF CAPITAL PTY LTD has sold AR licenses to over 20 similar entities, including Esmond. These companies have no direct relationship with MGF CAPITAL PTY LTD other than the purchased AR licenses. This widespread sale raises significant concerns about potential fraudulent activities and the legitimacy of Esmond’s operations.

3. Product Offerings and Trading Features

3.1 Forex Trading

Esmond provides CFDs for major currency pairs such as EUR/USD, GBP/USD, and USD/JPY. These instruments enable traders to profit from exchange rate fluctuations without holding the physical currencies.

3.2 Commodity CFDs

Commodity trading includes key raw materials such as crude oil, copper, and iron ore. Through commodity CFDs, investors can speculate on price movements without owning the physical assets.

3.3 Index CFDs

Esmond offers index CFDs that allow investors to trade on the performance of global indices like the S&P 500 and NASDAQ without purchasing the underlying components.

While these offerings cover diverse financial markets, the lack of transparency about trading conditions—such as spreads, leverage, and fees—raises red flags.

4. Trading Platform and Technical Support

4.1 MetaTrader 4 (MT4) Support

Esmond uses MetaTrader 4 (MT4), a widely popular trading platform known for its:

- Advanced Technical Analysis: Includes dozens of built-in indicators like MACD, RSI, and Bollinger Bands to identify market trends.

- Customizable Charts and Interface: Allows users to adapt layouts to their needs.

- Cross-Device Compatibility: Accessible on PC, web, and mobile devices, enabling trading on the go.

4.2 Lack of Enhanced Features

Although MT4 is a robust platform, Esmond does not appear to offer any additional optimizations or unique features, which makes it less appealing compared to competitors providing tailored platform enhancements.

5. Account Registration and Payment Policies

5.1 Simplified Registration with Limited Information

Users can register on Esmond’s website by providing basic information such as their name, country, email, and phone number. However, the company does not specify whether it offers demo accounts or provide details about account types, leaving potential clients in the dark.

5.2 Deposit and Withdrawal Options

Esmond supports deposits and withdrawals via domestic bank transfers and digital assets. Key details include:

- Fees: Deposits may incur fees, while withdrawals via local banks are generally free.

- Processing Times: Vary based on the payment method, but the company does not provide specific timelines or address potential delays.

This lack of transparency could cause unnecessary complications during transactions.

6. Customer Support and Service Quality

6.1 Limited Contact Options

Customer support is only available via email, with no phone or live chat functionality. This setup can delay assistance in urgent situations, adversely affecting user experience.

6.2 Impact on Investor Trust

Compared to competitors offering 24/7 live support, Esmond’s passive approach undermines its reliability and reduces customer confidence in its professionalism.

7. Key Risks for Investors

7.1 False Claims About Founding Date

Esmond’s claim of being established in 2019 contradicts ASIC records showing its registration in 2023, raising significant trust issues.

7.2 Weak Regulatory Backing

Operating under an AR license provides minimal oversight, offering limited protection to investors.

7.3 Suspicious Business Practices

The reliance on AR licenses for promotional purposes and association with over 20 similar entities raises concerns about the company’s legitimacy.

7.4 Lack of Operational History

With less than a month of operations, Esmond has no proven track record to demonstrate its reliability or effectiveness.

Conclusion

Esmond International Markets Pty Ltd aims to position itself as a credible player in the forex and CFD market through its MT4 platform and diverse financial products. However, its false claims about its founding date, weak regulatory framework, and lack of transparency severely undermine its credibility.

Investors considering Esmond’s services should proceed with extreme caution and conduct thorough due diligence to avoid potential financial scams.

FAQ

1. When was Esmond officially registered?

According to ASIC records, Esmond was registered in September 2023, not 2019 as it claims.

2. Does Esmond hold an ASIC license?

Esmond operates under an AR license purchased from MGF CAPITAL PTY LTD, offering limited oversight and protection.

3. What trading products does Esmond offer?

Esmond provides CFDs for forex, commodities, and indices.

4. What risks should investors watch out for?

Key risks include false claims, weak regulation, suspicious business practices, and lack of a proven operational history.

5. How reliable is Esmond’s customer support?

Customer support is limited to email communication, with no real-time assistance available, leading to slow response times.

6. What advantages does Esmond’s trading platform offer?

Esmond uses MT4, which offers robust analysis tools and cross-device compatibility but lacks unique enhancements or optimizations.