FXCess is one of the brands under Notesco Limited, founded on May 23, 2016, and registered in Cyprus. It offers financial trading services including forex, metals, indices, commodities, futures, and stocks. At first glance, FXCess provides a wide range of trading options, which may seem appealing to investors. However, is it truly a trustworthy platform? What are the potential risks hidden behind its offerings? Let’s take a closer look.

FXCess’s website provides various financial instruments and services, covering everything from forex to cryptocurrencies, stocks, and commodity futures. While this may seem like a great opportunity for investors, the operational model and regulatory status of FXCess raise several concerns. FXCess does not offer services to residents of certain countries such as the USA, Iran, Cuba, Sudan, Syria, and North Korea. Does this imply that it is avoiding the stricter regulations in those countries? Could there be hidden risks behind this?

Company Registration Information & Regulatory Status

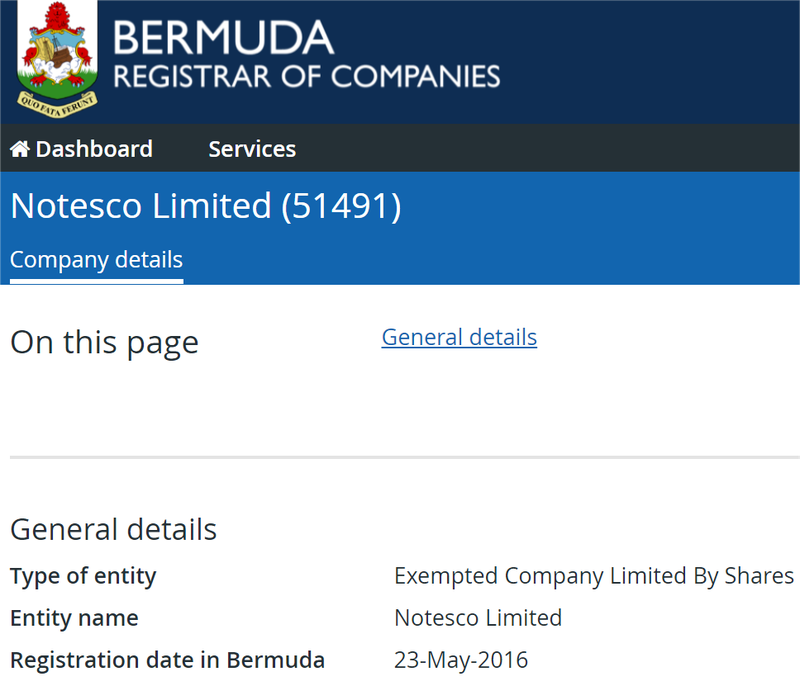

FXCess claims to be registered in Bermuda and operates under Notesco Limited. The company’s registered address is Nineteen, Second Floor #19 Queen Street, Hamilton HM 11, Bermuda, with registration number 51491. However, further investigation reveals that FXCess is not regulated by any official financial regulatory body. Bermuda itself does not regulate financial derivatives, meaning that the company lacks sufficient regulatory protection.

Can a platform with no regulation really be trusted? The absence of regulation means that investor funds are not protected, and in case of issues, it may be difficult for investors to seek legal recourse or compensation.

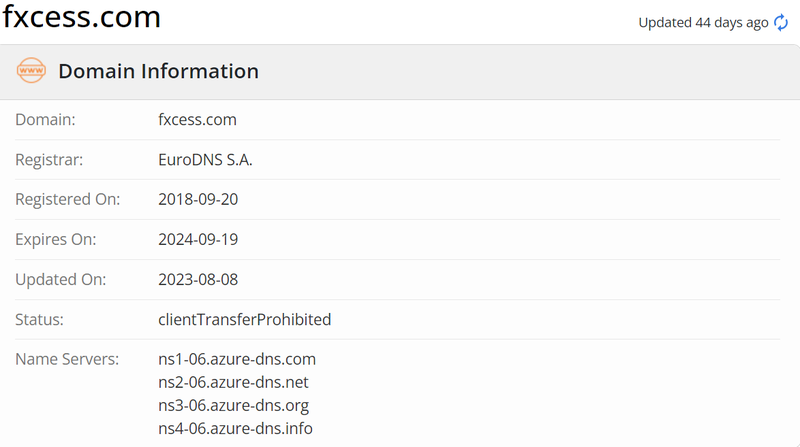

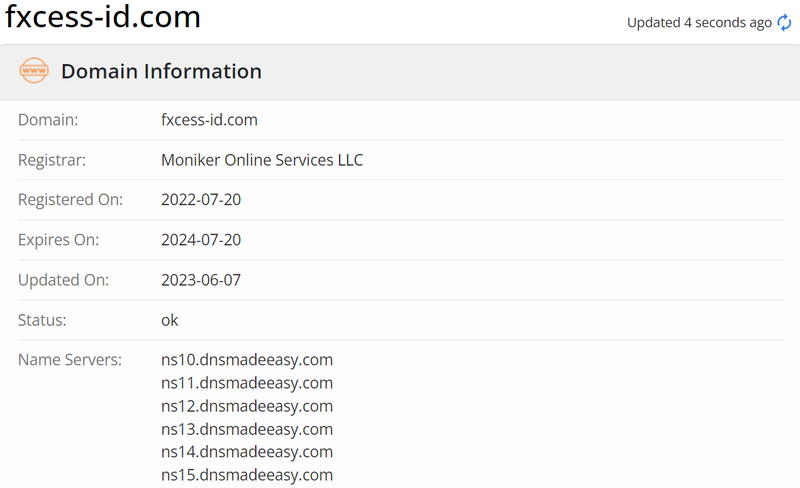

Additionally, Notesco Limited operates several well-known brokerage websites, including www.fxgiants.com, www.fxcess.com, www.fxcess-id.com, www.ironfx.com, www.ironfxcn.com, and www.fxlift.com. While these brands are somewhat recognized in the industry, they also lack licenses or oversight from major financial regulators. This raises doubts about the legitimacy and security of these platforms.

Account Types & Trading Conditions

FXCess offers two types of live trading accounts: Classic Account and ECN Account. Are the trading conditions as attractive as they seem?

Classic Account

- Minimum Deposit: $10

- Supported Base Currencies: EUR, GBP, JPY, USD, NGN, etc.

- Spread: From 1.7 pips

- Maximum Leverage: 1:1000

- Minimum Trade Volume: 0.01 lots

- Contract Size: 1 lot = 100,000

- Commission: No trading commission

- Additional Services: Islamic accounts and 24/5 dedicated account manager

The high leverage offered by this account might seem enticing, but high leverage often means greater risk. For traders without proper risk management strategies, this can lead to significant financial strain, especially during volatile market conditions. Furthermore, while there are no commissions, the spread starting from 1.7 pips can still increase the trading costs, particularly when the market is volatile.

ECN Account

- Minimum Deposit: $10

- Supported Base Currencies: EUR, GBP, JPY, USD, NGN, etc.

- Spread: From 0 pips

- Maximum Leverage: 1:500

- Minimum Trade Volume: 0.01 lots

- Contract Size: 1 lot = 100,000

- Commission: $4.5 per side per lot

- Additional Services: Islamic accounts and 24/5 dedicated account manager

While the ECN account offers lower spreads (from 0 pips), the $4.5 commission per lot per side might discourage high-frequency traders. If not properly accounted for, these commissions can quickly add up, eating into the profits.

Potential Risks & Warning Signs

Although FXCess offers low minimum deposits and diverse financial products, the potential risks behind its platform are clear. The lack of regulation means that investor funds are not guaranteed protection. Additionally, the high leverage and hidden fees could significantly increase the risk for investors, especially in the volatile forex and cryptocurrency markets. A sudden market shift can cause massive financial losses for those without adequate capital and risk management.

The allure of high leverage may attract short-term speculators, but for those without sufficient risk management experience, this could lead to substantial financial losses. In particular, during periods of market volatility, an investor’s margin could be quickly exhausted, resulting in a margin call or even account liquidation.

Furthermore, the commission structure and spread may hide additional risks. If a platform promises no commission, the spread may be inflated to compensate. For the ECN account, while the spread is low, the commission of $4.5 per lot may significantly increase the costs for frequent traders, reducing the potential profits.

Conclusion

In summary, FXCess offers attractive trading conditions, but the hidden risks behind its platform cannot be overlooked. The absence of regulation leaves investor funds unprotected, while the high leverage and hidden fees could result in significant financial losses. Before deciding to trade with FXCess, investors should carefully weigh these risks and ensure they have the capacity to handle the financial pressures that may arise.

Frequently Asked Questions (FAQ)

1. Is FXCess regulated?

No, FXCess is not regulated by any major financial authority. Bermuda itself does not regulate financial derivatives, so there is no regulatory protection.

2. What types of accounts does FXCess offer?

FXCess offers Classic Accounts and ECN Accounts, with the Classic Account having no commissions and the ECN Account charging a $4.5 commission per side per lot.

3. What is the leverage offered by FXCess?

The Classic Account offers leverage up to 1:1000, while the ECN Account offers leverage up to 1:500. Be aware that high leverage comes with significant risk.

4. Does FXCess charge trading fees?

The Classic Account does not charge trading commissions, but the ECN Account charges $4.5 per lot per side as commission. These additional costs can add up quickly, especially for frequent traders.

5. Is FXCess safe?

Due to the lack of regulation, FXCess carries significant risks. Investors need to be cautious and ensure they understand and can handle these risks before trading with the platform.