This article thoroughly analyzes Next Level Pro Traders’ background, regulatory information, profit promises, and risks to help investors identify potential financial pitfalls.

1. Background of Next Level Pro Traders

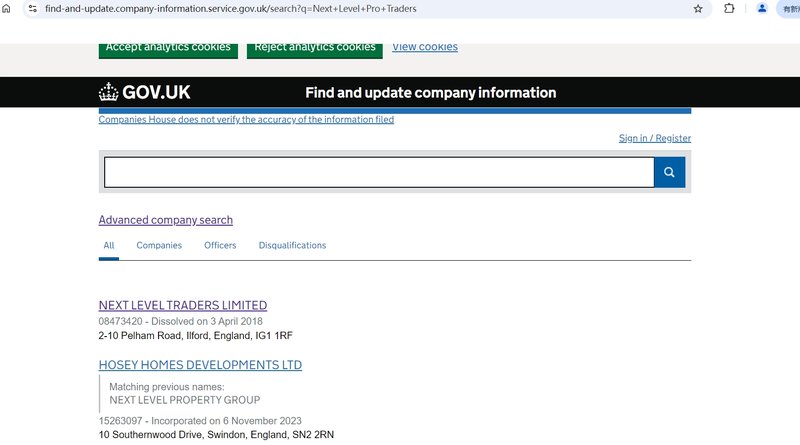

Next Level Pro Traders claims to be an online platform offering trading products across forex, cryptocurrencies, indices, stocks, energy, and commodities, aiming to attract global investors. However, research reveals multiple irregularities and potential risks associated with this platform. According to its website, the platform’s registered address is listed as Wenlock Road 20-22N1 7GU, London, UK. Yet, no official company registration information matches “Next Level Pro Traders.” The only similar entity is “Next Level Traders Limited,” with no direct affiliation to this platform. This absence of concrete registration details casts doubt on the platform’s legitimacy, suggesting it may lack formal registration in the UK.

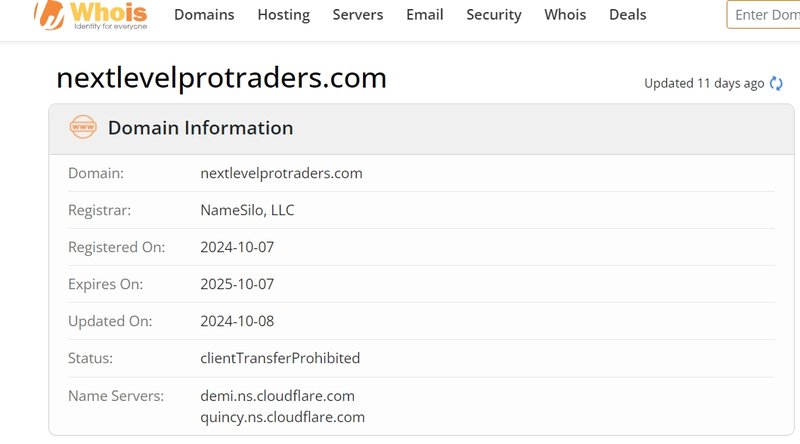

1.1 Domain Information and Establishment Date

Next Level Pro Traders registered its domain on October 7, 2024, revealing a very short operational history. Domain age serves as a crucial indicator when assessing the legitimacy of a financial platform. Newly established trading platforms, particularly those with unclear transparency and regulatory credentials, pose a higher risk of financial losses for users.

1.2 Risks from Lack of Registered Entity Information

Most legitimate financial platforms disclose company registration numbers, registered addresses, and contact details on their official websites to demonstrate transparency and legality. Next Level Pro Traders fails to provide sufficient registration details, making it difficult for investors to verify the platform’s credentials. This lack of transparency is particularly concerning given that the UK is a highly regulated financial hub; without formal registration information matching the platform’s name, investors have legitimate reasons to question its authenticity.

2. Regulatory Information: False Claims and Risks

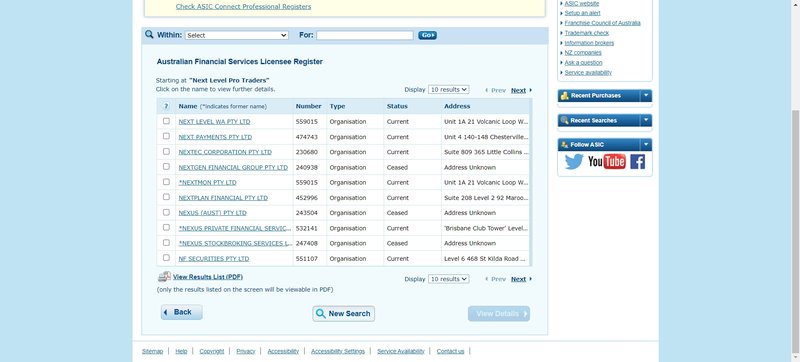

Next Level Pro Traders claims regulation by the Australian Securities and Investments Commission (ASIC). However, verification shows the platform lacks licensing from ASIC or any reputable financial regulatory agency. This misleading claim heightens the platform’s risk profile, as lack of regulation means it isn’t bound by strict financial laws or investor protections. For unregulated platforms, customer fund safety and user protection mechanisms are often lacking, leaving investors’ funds vulnerable.

2.1 Risks Associated with Unregulated Platforms

Legitimate financial platforms are generally required to follow strict regulatory standards, including fund segregation, investor protection, and transparency to ensure user fund safety. However, Next Level Pro Traders operates without regulatory backing, meaning that investors face significant risk with little to no legal recourse in case of disputes or financial losses. This lack of regulatory compliance is particularly detrimental for investors trading high-risk financial products.

2.2 Warnings of Misleading Claims

Unregulated trading platforms often lure investors with exaggerated returns and misleading claims about regulatory oversight. Although Next Level Pro Traders claims to be regulated by ASIC, this false information is common among high-risk investment scams. Investors are urged to verify a platform’s regulatory status thoroughly before investing to avoid falling victim to fraudulent advertising.

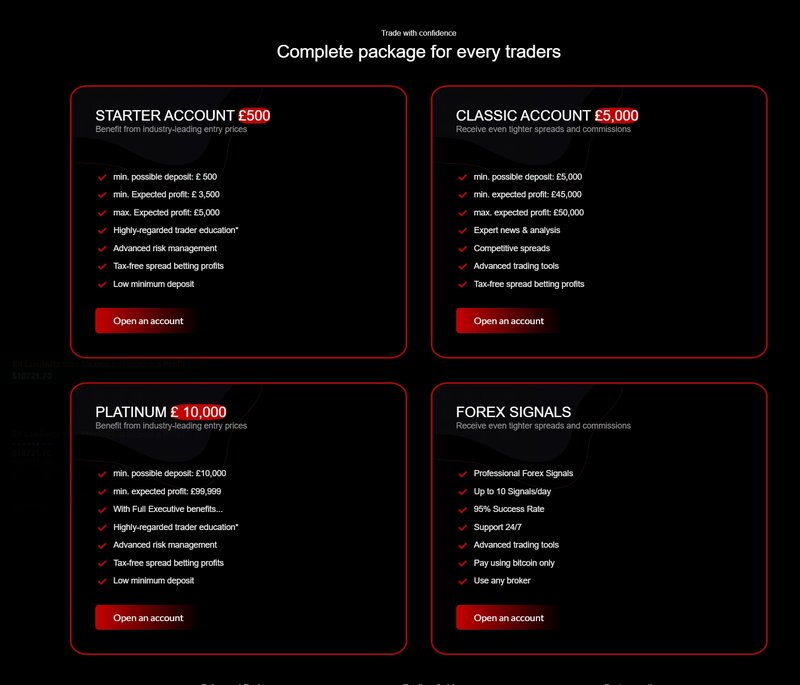

3. Deposit Requirements and High Profit Promises

Next Level Pro Traders offers three account types with varying minimum deposit requirements and substantial profit promises designed to attract high investor deposits. Here are the account types offered:

- Starter Account: Minimum deposit of £500 with promised returns of £3,500 to £5,000.

- Classic Account: Minimum deposit of £5,000 with promised returns of £45,000 to £50,000.

- Platinum Account: Minimum deposit of £10,000 with promised returns of up to £99,999.

3.1 Range of Deposit Requirements and Risks of High Profit Promises

From the £500 minimum for the Starter Account to the £10,000 required for the Platinum Account, the platform sets a relatively low entry barrier while using extremely high return promises to encourage larger deposits. Superficially, these accounts appear highly attractive, yet such “guaranteed high returns” are nearly impossible in legitimate financial markets. Actual investment returns depend on market conditions, investment strategies, and individual decision-making. Any “guaranteed returns” claims are fundamentally unrealistic.

3.2 Analyzing the Reasonableness of Profit Promises

The profit promises from Next Level Pro Traders are highly exaggerated and lack plausibility. In legitimate financial markets, no platform can legally guarantee specific returns. Standard practices for regulated platforms include transparent risk disclosures and reasonable expectations, stressing that all trading involves risk. However, Next Level Pro Traders’ unrealistic high-profit promises could be a tactic to encourage larger deposits, a common approach used in investment scams. Investors are advised to remain cautious and avoid being misled by these unrealistic promises.

4. Spread, Leverage, and Commission Conditions

Next Level Pro Traders claims to offer leverage as high as 1:500 and commission rates as low as 0.08%. At first glance, these conditions may seem advantageous, potentially enhancing profit opportunities. However, on an unregulated and opaque platform, such high leverage can significantly increase financial risks.

4.1 Risks of High Leverage

A leverage ratio of 1:500 is exceptionally high and uncommon in the industry. Regulated platforms typically cap leverage at around 1:30 to 1:100 to help investors manage risk. High leverage may magnify returns, but it equally amplifies potential losses, especially during volatile market conditions. Unregulated platforms using high leverage expose users to greater risks, as these platforms have no responsibility to safeguard client funds.

4.2 Attractive Low Commission and Hidden Cost Risks

Next Level Pro Traders claims a commission rate as low as 0.08%, but does not clearly outline specific trading costs and conditions. Whether such commission rates are sustainable is unknown, and the lack of transparency could indicate hidden fees that increase actual trading costs. Regulated platforms usually provide detailed fee breakdowns, while Next Level Pro Traders’ commission structure remains vague, potentially exposing users to hidden charges.

5. Lack of Transparency in Deposit and Withdrawal Methods

Next Level Pro Traders has not provided specific information on deposit and withdrawal methods or fees on its website. For investors, clearly stated deposit and withdrawal procedures and fee structures are critical indicators of a platform’s reliability.

5.1 Non-Transparent Fund Transfer Methods

Legitimate platforms typically offer various deposit and withdrawal methods, such as bank transfers, credit cards, and e-wallets, while also detailing transaction fees and processing times. Next Level Pro Traders has not disclosed its deposit and withdrawal options, meaning investors may face unclear processes and unexpected fees. This lack of specific payment method information can result in difficulties withdrawing funds and unforeseen costs.

5.2 Fund Security Concerns

The security of users’ funds is difficult to guarantee without transparent deposit and withdrawal processes. Limited fund transfer options could impact liquidity, and investors may face challenges withdrawing funds. Lack of transparency in deposit and withdrawal methods is often a red flag, especially for high-risk platforms. Investors should exercise extreme caution.

6. Conclusion: Potential Risks of Next Level Pro Traders

Overall, Next Level Pro Traders promises high returns and multiple account options, yet there are serious concerns surrounding its background, registration, regulatory status, profit promises, and transparency around deposit and withdrawal methods. The platform does not disclose a legitimate company registration, nor is it recognized by any regulatory agency, leaving users’ funds unsecured. High-profit promises, extreme leverage, and non-transparent payment methods all indicate elevated financial risks for investors.

Investors are strongly encouraged to prioritize compliant platforms and avoid high-risk platforms like Next Level Pro Traders. Maintaining rational judgment and avoiding high-profit promises can help protect one’s financial security.

Frequently Asked Questions (FAQ)

1. Is Next Level Pro Traders regulated?

The platform claims to be regulated by ASIC, but research shows it lacks any actual regulatory credentials and operates as an unregulated platform.

2. What are the minimum and maximum deposits for Next Level Pro Traders?

Minimum deposit starts at £500 (Starter Account), with the highest at £10,000 (Platinum Account).

3. Are the platform’s high-profit promises realistic?

The high-profit promises are implausible. Legitimate platforms cannot guarantee fixed returns; such high-profit claims are often signs of a scam.

4. What are the leverage and commission rates offered by the platform?

The platform offers leverage up to 1:500 and commissions as low as 0.08%. However, this high leverage comes with added risk, and the commission structure lacks transparency.

5. What are the deposit and withdrawal methods for Next Level Pro Traders?

The platform does not specify its deposit and withdrawal methods, increasing concerns about fund transparency and security.

6. How can investors identify safe trading platforms?

To choose a safe platform, investors should verify its registration, regulatory credentials, clear fee structures, and user protection measures to ensure financial security.