Aircrypt Trades is a newly established online trading platform offering various financial products like forex, CFDs, and cryptocurrencies. Due to its lack of regulation, inconsistent registration information, and limited transparency, investors should proceed with caution.

Company Background: Inconsistent Information and Lack of Transparency

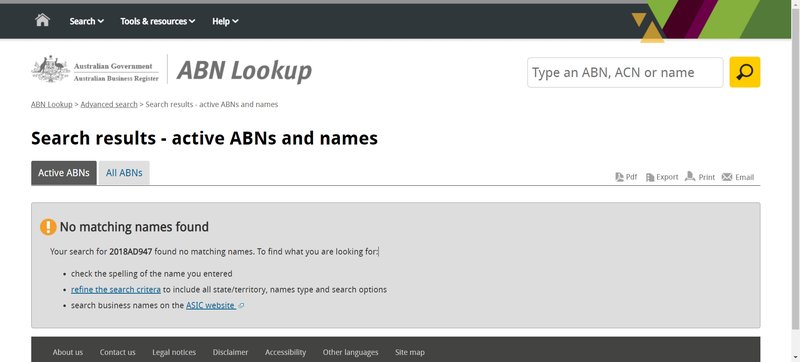

1.1 Invalid Registration Information and ABN

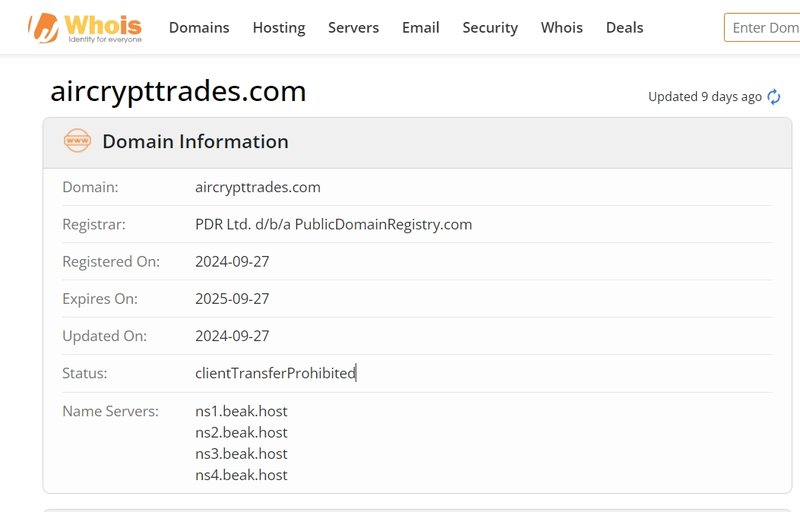

Aircrypt Trades was established in 2024, with its website at https://aircrypttrades.com, and its domain registered on September 27, 2024, indicating a short operational history. The platform lists an ABN (2018AD947), but this number is invalid, with no traceable legal entity. Such inconsistencies raise doubts about the legitimacy of its registration, suggesting that the platform may not have a valid legal backing.

Legitimate financial platforms typically provide verifiable registration details and company information to help build trust with investors. In contrast, Aircrypt Trades lacks clear company data, leaving investors unable to verify its operational background. This missing information raises questions about the platform’s authenticity, which may only use surface-level registration details as a marketing tactic without actual legal backing.

1.2 Risks of an Unregulated Platform

As an unregulated platform, Aircrypt Trades lacks oversight by any financial regulatory authority. This means its operations are unsupervised, and users’ funds and personal data are not safeguarded. In a regulated financial environment, oversight ensures legal compliance and provides critical protections for customer funds and data. However, the lack of regulatory backing for Aircrypt Trades exposes investors to high risks.

Unregulated platforms often lack transparency and accountability. Should issues arise—such as withdrawal difficulties or transaction irregularities—investors are often left without recourse. Additionally, many unregulated platforms create obstacles for users’ fund access or withdrawal, sometimes even restricting access entirely. Investors should exercise extreme caution when dealing with such platforms.

Domain Analysis: Risks Associated with a Newly Registered Domain

2.1 Short Domain Registration Period

Aircrypt Trades registered its domain on September 27, 2024, reflecting its recent entry into the market. With such a short history, the platform has not yet proven itself in terms of reliability. Financial investment platforms benefit from a long-standing market presence, which lends credibility and reliability, but companies with recently registered domains lack both user reviews and trust. Short-lived platforms frequently pose risks, as they may exit the market unexpectedly due to management or operational issues.

When choosing a platform, investors should consider its stability and reputation. New platforms are more susceptible to mismanagement, regulatory challenges, and reputational issues, which could lead to unexpected closures, putting investor funds at risk.

2.2 Risks of New Platforms

Newly established platforms often lack market resilience and are vulnerable to operational instability. Limited experience and customer service capabilities can make problem resolution challenging. Some newer platforms may also engage in opaque practices, such as spread manipulation or withdrawal delays, raising user risk. Investors should approach new platforms like Aircrypt Trades cautiously to avoid losses from instability.

Account Structure: High Deposit Thresholds and Lack of Transparency

3.1 High Minimum Deposits for Account Types

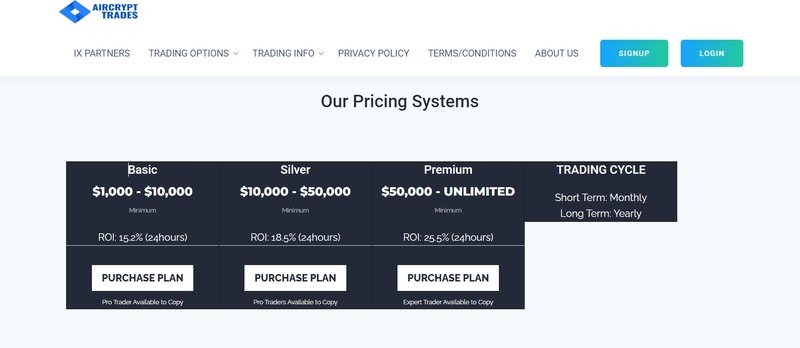

Aircrypt Trades offers three account types: Basic, Silver, and Premium, each with a different minimum deposit range:

- Basic: $1,000 – $10,000

- Silver: $10,000 – $50,000

- Premium: Minimum deposit of $50,000 with no upper limit

While these accounts seemingly cater to various investment levels, they lack clarity and transparency. The account information does not specify the benefits or services associated with each tier, making it hard for investors to distinguish between the options. Most reputable platforms clearly outline account benefits to help users make informed choices, but Aircrypt Trades’ high deposit requirements seem designed to encourage larger deposits without clear security or benefits.

3.2 Lack of Detailed Account Information

Without clear descriptions of account benefits, investors have no insight into the services they’ll receive. Important details, such as transaction fees, withdrawal policies, and additional perks, remain unknown. For investors who value informed decision-making, this vague account setup means that once funds are deposited, the lack of transparency makes accessing them more challenging.

Deposit and Withdrawal Process: Risks from Lack of Transparency

4.1 Missing Information on Deposit and Withdrawal Methods

Aircrypt Trades does not provide specifics about its deposit and withdrawal methods on its website. Transparent processes for fund transfers are essential to ensure the safety and liquidity of users’ funds. A lack of clear channels or process details may indicate that the platform could create obstacles during withdrawals, preventing users from accessing their funds when needed. Regulated platforms typically provide a detailed list of available payment methods, transaction fees, and processing times to assure users of safe and timely fund access.

In the absence of disclosed withdrawal methods, investors face greater liquidity risks. Furthermore, unregulated platforms like Aircrypt Trades often create obstacles in the withdrawal process, restricting users’ access to their funds, especially after significant deposits. Caution is advised for investors considering such platforms.

4.2 Liquidity Risks and Withdrawal Issues

Liquidity is critical in financial markets, enabling users to access their funds easily. Aircrypt Trades’ lack of transparency regarding withdrawals may prevent users from timely fund access, increasing financial risk. In cases where users encounter liquidity issues, they may find it difficult to obtain effective customer support. Additionally, without regulatory oversight, the platform can implement restrictive withdrawal practices at its discretion. Investors should carefully weigh the risks of liquidity and platform reliability before making substantial deposits.

Lack of Educational Resources: Insufficient Support for New Traders

5.1 Risks of Limited Educational Support

Aircrypt Trades does not provide any educational resources, such as market analysis, trading guides, videos, or real-time market updates. For investors aiming to improve their skills and market knowledge, such resources are invaluable. Reputable trading platforms usually offer diverse educational tools to help users grow and make informed decisions, particularly for new traders. By omitting educational resources, Aircrypt Trades limits its users’ ability to make well-informed trading decisions.

The absence of these resources not only disadvantages beginner traders but also suggests a lack of long-term focus on user development. Without educational tools, inexperienced investors may make uninformed decisions, increasing their exposure to losses.

5.2 Impact on Investor Growth

For new traders, educational resources are essential for building foundational knowledge and managing risk effectively. A lack of resources places users in a vulnerable position, as they may not fully understand the market or trading strategies. Aircrypt Trades’ disregard for educational support indicates its lack of commitment to users’ growth, instead focusing on attracting deposits rather than fostering long-term value for its clients.

Conclusion: Caution Advised When Dealing with Aircrypt Trades

In summary, Aircrypt Trades is an unregulated trading platform with a short operating history, inconsistent registration details, high deposit thresholds, and insufficient transparency in its account structures, deposit/withdrawal methods, and educational support. Without regulatory oversight or transparency, trading with this platform could pose significant risks for investors. It is strongly recommended that potential users approach Aircrypt Trades with caution and conduct thorough research before making any deposits.

FAQ

- Is Aircrypt Trades regulated?

Answer: No, Aircrypt Trades is an unregulated platform, offering no safeguards for user funds. - Is the ABN provided by Aircrypt Trades valid?

Answer: No, the ABN number listed is invalid and lacks legal backing. - What are the differences among the account types?

Answer: Aircrypt Trades offers Basic, Silver, and Premium accounts, but the specific benefits of each type are not clearly disclosed. - Are deposit and withdrawal processes transparent?

Answer: No, Aircrypt Trades does not provide specific information on deposit and withdrawal methods, which may lead to withdrawal obstacles. - Does Aircrypt Trades offer educational resources?

Answer: No, the platform does not provide any educational materials, which could be challenging for beginners. - Is trading on Aircrypt Trades safe?

Answer: Due to its lack of regulation and transparency, trading on Aircrypt Trades carries high risks. Proceed with caution.