This article provides a detailed analysis of Trans X Market’s company background, domain registration information, regulatory status, account types, spreads, and leverage, helping investors assess the platform’s potential risks and offering suggestions for choosing safe trading platforms.

1. Company Background

1.1 Overview and Operational Information

Trans X Market Limited claims to offer trading services for various financial products, including forex, indices, and commodities. The platform’s official statement identifies Trans X Market Limited as the operating company, with the website at https://transxmarket.com. The platform promotes itself as providing a secure and stable trading environment suitable for both novice and experienced traders.

However, despite these claims, Trans X Market’s actual operational information lacks transparency and involves significant risks. In-depth investigations reveal several uncertainties regarding the platform’s company background, especially concerning its registration and corporate structure.

1.2 Unclear Registration Information

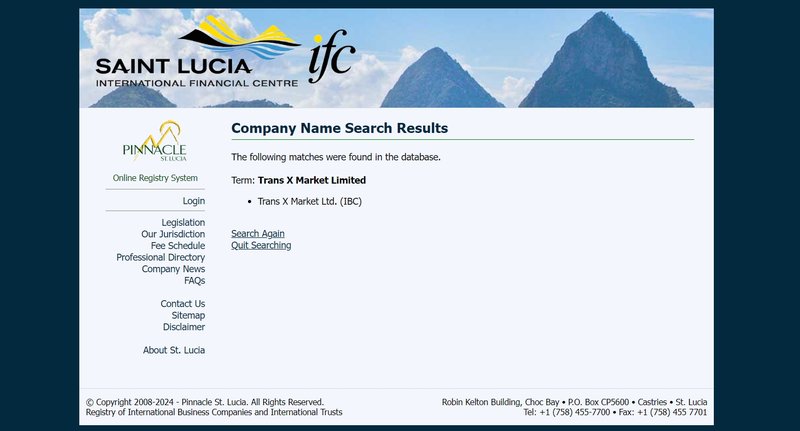

Trans X Market claims to be registered in Saint Lucia and states it has an IBC (International Business Company) number, 2023-00543, from the Saint Lucia Financial Services Registry. However, further investigation shows no such company registration information in Saint Lucia’s official database.

This issue significantly undermines the legitimacy of Trans X Market. A legitimate company should be verifiable in its home country’s government database and provide complete corporate information. Trans X Market’s failure to provide detailed registration information poses a substantial risk to investors.

2. Domain Information

2.1 Risks of Domain Registration Time

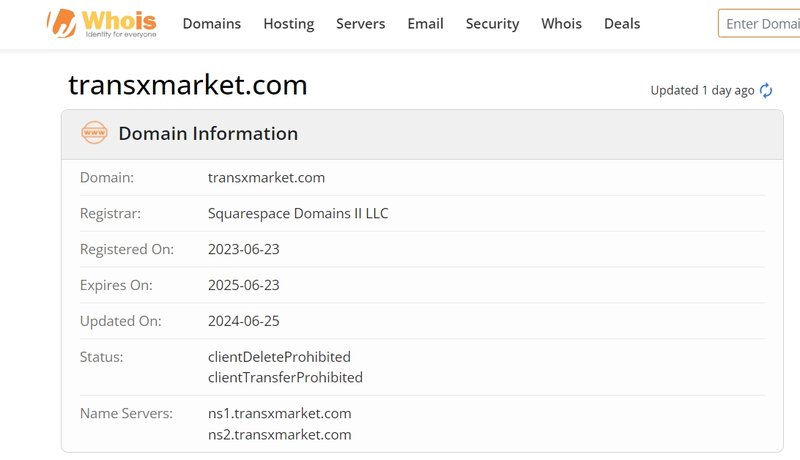

According to the Whois database, Trans X Market registered its domain on June 23, 2023. This indicates that the platform has been in operation for a very short time and has not undergone long-term market validation. Compared to established financial platforms, Trans X Market has a limited operational history and lacks reliable trading records or market feedback.

For any trading platform, the domain registration time and the company’s operational history are essential indicators of reliability. Particularly in the financial industry, long-standing platforms often build trust through their longevity, while short-term platforms carry higher risks. Without a proven history, investors cannot assess a platform’s safety based on past trading data or customer reviews.

2.2 Risks Associated with Newly Established Platforms

The short domain registration time suggests that the platform may be a short-term project, posing potential risks of sudden closure or fraudulent behavior, such as stealing client funds. In the forex and CFD trading space, some platforms attract investors’ deposits and then restrict withdrawals or close operations, making it impossible for investors to recover their funds.

Therefore, investors should be cautious about platforms with short registration times and no market validation. It’s advisable to choose well-established companies with years of market experience and substantial customer feedback to reduce risks.

3. Lack of Effective Regulation

3.1 Discrepancies in Regulatory Claims

Trans X Market claims to be regulated by the Saint Lucia Financial Services Registry and provides an IBC number. However, Saint Lucia does not regulate financial derivatives, meaning even if the platform is registered there, it is not subject to stringent financial oversight. Further investigation reveals that Saint Lucia does not regulate forex or CFD trading, rendering Trans X Market’s regulatory claim invalid.

Legitimate forex and CFD platforms are typically regulated by internationally recognized financial authorities such as the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). These regulators impose strict requirements on platform operations, including the segregation of client funds, transparency, and compliance. Regulated platforms must submit regular financial reports and ensure client funds are protected in the event of platform issues.

3.2 Risks of an Unregulated Platform

Trans X Market has failed to provide any proof of regulation by internationally recognized financial authorities. This lack of regulation means the platform can handle client funds without external supervision. Unregulated platforms often harm investors through hidden fees, withdrawal restrictions, and market manipulation. Without oversight, investors who encounter problems will find it difficult to recover losses through legal means.

Another risk of unregulated platforms is that they may close operations after a period, taking investor funds with them. Since no regulatory body monitors such platforms, investor rights are left unprotected. Choosing a platform overseen by a recognized regulatory authority is essential to safeguard funds.

4. Questionable Account Information

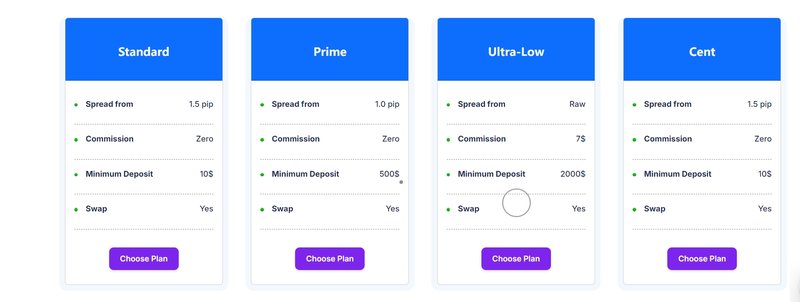

4.1 Standard Account

Trans X Market offers a Standard account for beginner traders, with a minimum deposit of $10, spreads starting from 1.5 pips, and no commissions. On the surface, this account design appears to attract low-budget investors. However, the low entry requirements come with high spreads, making the actual cost of trading potentially higher than it seems.

While the platform claims no commissions, the higher spreads may already include some hidden costs, meaning traders may not realize these fees when trading. The platform does not clearly explain its withdrawal policies or potential maintenance fees, raising concerns about investors facing difficulties withdrawing funds later.

4.2 Prime Account

The Prime account has a minimum deposit requirement of $500, spreads starting from 1.0 pips, and no commissions. Compared to the Standard account, the Prime account offers lower spreads but does not provide details on other fees. Typically, platforms with low-commission accounts generate revenue through other means, such as wider spreads or additional charges.

Moreover, the Prime account’s high leverage means investors can trade larger positions with less margin, but this also increases the risks of trading. The higher the leverage, the greater the risk of significant losses during market volatility. Investors should be cautious when choosing high-leverage accounts and ensure they have adequate risk management skills.

4.3 Ultra-Low Account

The Ultra-Low account requires a minimum deposit of $2000 and offers raw spreads, but the platform charges $7 per lot in commissions. This account seems designed to offer more transparent trading conditions for advanced traders, with raw spreads providing lower-cost trades.

However, the high deposit requirement may not appeal to average investors. Additionally, while the account charges $7 per lot, it’s unclear whether other hidden fees exist. After depositing funds, investors may face higher-than-expected costs or encounter difficulties withdrawing funds.

4.4 Cent Account

The Cent account also requires a minimum deposit of $10, with spreads starting from 1.5 pips and no commissions. This account targets small-scale traders, allowing them to trade forex with smaller amounts. However, the widened spreads could result in higher trading costs, especially in volatile markets, potentially impacting profitability.

5. Unreasonable Spreads and Leverage

5.1 Risks of High Leverage

Trans X Market offers leverage as high as 1:3000, particularly in its Standard and Cent accounts. While high leverage seems attractive by amplifying potential profits, it also significantly increases the risk of losses. In volatile markets, the risk of an account being liquidated rises exponentially. For beginners or inexperienced traders, using high leverage can quickly deplete an account.

Reputable regulatory bodies usually impose strict limits on leverage for retail investors. For instance, the European Securities and Markets Authority (ESMA) limits leverage to 1:30, while the Australian Securities and Investments Commission (ASIC) caps it at 1:50. Trans X Market’s leverage of 1:3000 far exceeds these safety limits, exposing investors to substantial risks.

5.2 Lack of Transparency in Spreads and Commissions

While Trans X Market claims its spreads range from 1.0 to 1.5 pips and some accounts have no commissions, it does not provide a full breakdown of other potential trading costs. Spreads are crucial in determining trading costs, and platforms should provide transparent information about spread ranges and fluctuations.

Trading commissions are another key factor for investors when choosing a platform. Trans X Market charges $7 per lot in commissions for Ultra-Low accounts but does not explain the commission structure for other accounts. Additionally, the platform does not disclose potential fees for withdrawals or account management, making it difficult for investors to predict the actual cost of trading.

Trans X Market presents several significant risks. First, the platform lacks transparency in its company background and registration information, has a short domain registration period, and is not regulated by any recognized financial authority, raising concerns about fund safety. While the platform offers various account types, there are significant risks related to fee transparency and high leverage. High leverage may attract some traders, but it also amplifies the risk of losses, especially for beginners.

Given these concerns, investors should exercise caution and avoid platforms that lack transparency and regulation, as they may suffer unnecessary financial losses.

Investors are advised to choose platforms regulated by internationally recognized financial authorities (such as the FCA, ASIC, or CySEC) to ensure the safety of their funds and transparent trading conditions.

FAQ

- Is Trans X Market regulated?

Trans X Market claims to be registered in Saint Lucia but has not provided any valid financial regulation proof, making it an unregulated platform. - When was Trans X Market’s domain registered?

The platform’s domain was registered on June 23, 2023, indicating a short operational period without long-term market validation. - What account types does Trans X Market offer?

The platform offers Standard, Prime, Ultra-Low, and Cent accounts, each with varying minimum deposit amounts and spreads. - What is Trans X Market’s leverage?

The platform offers leverage up to 1:3000, which far exceeds the safety limits imposed by global regulatory authorities and poses high risks. - Are Trans X Market’s spreads and commissions transparent?

The platform has not disclosed all trading fees clearly. Although some accounts offer no-commission trading, hidden fees may exist, and overall transparency is lacking. - How do I choose a safe trading platform?

Investors should select platforms regulated by internationally recognized financial authorities (such as the FCA, ASIC, or CySEC) to ensure fund safety and trading transparency.