JDR Securities is an Australian forex broker established in 2021. Despite holding several licenses, there are concerns about its Authorized Representative (AR) license and regulatory status. Investors should approach this platform with caution.

Platform Background Overview

JDR Securities was founded in 2021 and is based in Sydney, Australia. It is a broker that offers financial derivative trading services, focusing on forex, indices, and commodities. The company has extended its operations through associated entities in New Zealand and Saint Vincent and the Grenadines, branding itself as a participant in global financial markets. While JDR Securities has quickly established a cross-border corporate network, investors must carefully examine its actual regulatory status, corporate transparency, and trading conditions to ensure fund security and fair trading practices.

The company operates under JDR Securities (Australia) Pty Ltd and provides forex and CFD trading services through the MetaTrader platform. JDR Securities attracts investors with features like high leverage and no minimum deposit requirements. However, concerns about its regulatory status and licenses raise significant red flags for investors.

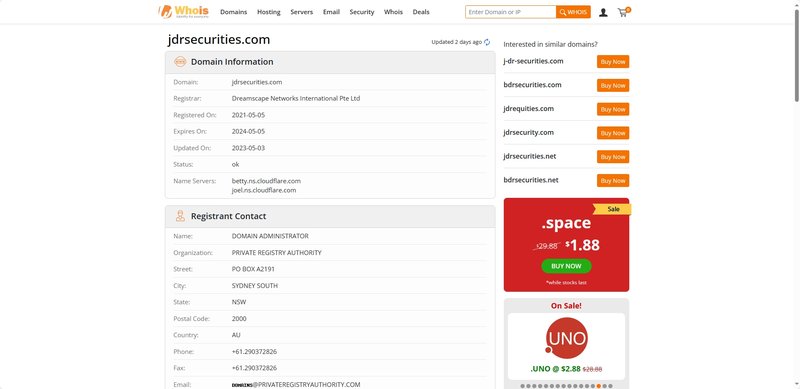

Domain Information

JDR Securities registered its official domain on January 11, 2021, three months before the company’s formal establishment. This indicates that the company had a clear plan for its online presence and built its digital platform early on. While the domain history offers some insight into the company’s timeline, it is not enough to assess the platform’s safety or credibility. Domain registration history only reveals a short operational record, so investors need to evaluate the company’s registration, regulatory status, and trading information for a more comprehensive assessment.

Registration Information and Risks

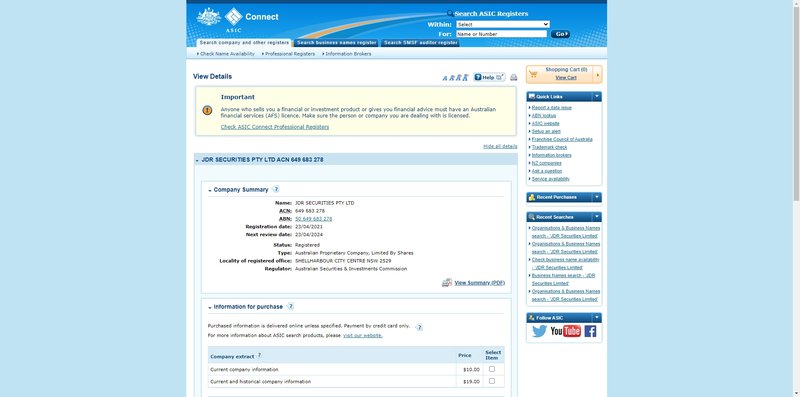

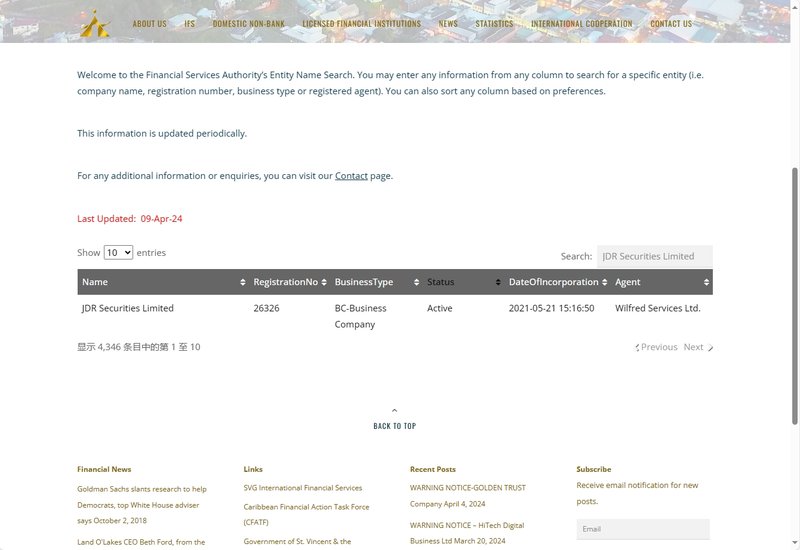

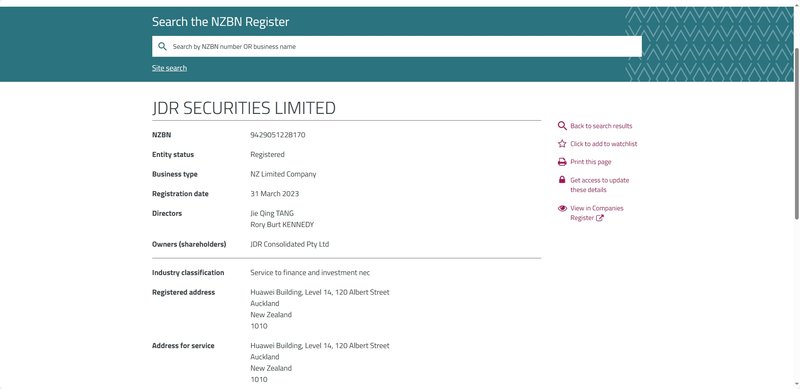

JDR Securities operates under the entity JDR Securities (Australia) Pty Ltd, registered on April 23, 2021, with an address in Sydney, Australia. The company also includes affiliated entities in New Zealand under JDR Securities Limited, with registration number 9429051228170, and in Saint Vincent and the Grenadines, with registration number 26326. These multiple registrations suggest that JDR Securities operates in several jurisdictions. However, registering in multiple regions does not guarantee regulation in those areas, particularly in loosely regulated jurisdictions like Saint Vincent and the Grenadines.

Risk Analysis of Registration Information:

- Disconnection between Multi-Region Registration and Regulation: Although JDR Securities is registered in New Zealand and Saint Vincent and the Grenadines, loose financial regulation in these regions risks fund security. In particular, Saint Vincent and the Grenadines is a common registration location for forex brokers, but its Financial Services Authority (SVGFSA) does not provide effective regulation for forex brokers or CFD businesses. This means that JDR Securities’ registration in these countries does not ensure regulatory protection.

- Potentially Misleading or Vague Registration Information: While JDR Securities has published its registration details for Australia, New Zealand, and Saint Vincent and the Grenadines, the platform’s legitimacy and compliance are still in doubt due to the lack of thorough regulatory scrutiny.

Regulatory Concerns

There are significant concerns regarding JDR Securities’ regulatory status. Although the company claims to hold an Authorized Representative (AR) license from the Australian Securities and Investments Commission (ASIC), this type of license involves lower levels of regulatory oversight. Moreover, JDR Securities uses an AR license from Royal Financial Trading Pty Ltd rather than having direct ASIC regulation. This means that JDR Securities is not subject to strict financial regulation but is instead relying on another company’s license for its operations.

Risk Analysis of Regulatory Information:

- Limitations of the AR License: JDR Securities is not directly regulated by ASIC but operates under Royal Financial Trading Pty Ltd’s Authorized Representative (AR) license. This type of license offers weaker oversight, as AR license holders only need to meet the minimum standards set by the parent company, rather than meeting ASIC’s full regulatory requirements. This arrangement raises questions about JDR Securities’ compliance and trading transparency.

- Possibility of Misleading Claims: JDR Securities claims to be regulated in multiple regions, but aside from the New Zealand Financial Markets Authority (FMA), the company is not subject to meaningful regulation elsewhere. Specifically, the SVGFSA in Saint Vincent and the Grenadines clearly states that it does not regulate forex trading or brokerage businesses. Investors should be cautious of platforms that may exaggerate their regulatory status.

Account Types and Trading Concerns

JDR Securities offers two main account types: Standard Account and Professional Account. While these accounts appear to cater to different types of traders, the trading conditions and fee structures present potential risks for investors.

Standard Account Concerns and Risks

The Standard Account offers spreads as low as 1.0 pip with no commission, which may seem attractive to regular traders. However, there are hidden costs and trading limitations that need to be considered.

- Risk of Spread Widening: While a spread of 1.0 pip may seem reasonable under normal market conditions, spreads can widen significantly during times of high volatility. Given JDR Securities’ lack of strict regulation, the platform may adjust spreads at will, increasing trading costs during critical market moments.

- Hidden Trading Costs: Although the Standard Account does not charge direct commissions, the relatively wide spreads effectively increase the hidden costs per trade. For high-frequency traders, these costs can accumulate and significantly reduce profitability over time.

Professional Account Concerns and Risks

The Professional Account offers spreads starting from 0 pips, with a commission of $7 per lot. This account is typically aimed at high-frequency traders or professional investors. However, the commission structure and high leverage pose serious risks.

- Sustainability of 0-Pip Spreads: While 0-pip spreads are highly attractive, particularly for high-frequency traders, they are not always achievable in real market conditions. Unregulated platforms may find ways to supplement their income through other means, such as widening spreads or manipulating prices during periods of high market volatility.

- Potential Dangers of High Leverage: JDR Securities offers leverage of up to 400:1. While this can significantly amplify profits, it also dramatically increases trading risk. High leverage can result in substantial losses from minor market fluctuations. Without effective risk management measures, investors could see their funds wiped out in a short time.

Common Account Risks

- Lack of Fund Protection: Despite offering flexible account options, JDR Securities does not clearly outline its fund protection measures. There is no clear information on whether the platform offers fund segregation or investor compensation schemes. This means that if the platform encounters financial difficulties or bankruptcy, investors’ funds may not be adequately protected.

- Forced Liquidation and Slippage Risk: Both accounts set the margin call level at 50%, triggering forced position closures if the balance drops below a certain point. On unregulated platforms, forced liquidations can occur under unfavorable conditions, causing additional losses for investors. Slippage is also a common issue in forex trading, and during high volatility, large slippage can impact the trader’s profit and loss.

Conclusion

While JDR Securities is registered in Australia, New Zealand, and Saint Vincent and the Grenadines, its regulatory status has significant gaps. The platform’s reliance on an AR license from Royal Financial Trading Pty Ltd reduces its compliance and transparency. Additionally, the hidden trading costs, slippage risks, and high leverage policies within the account types increase the overall risk for investors. Although JDR Securities offers a variety of trading platforms and account types, its underlying risks and lack of effective regulation mean that investors should exercise extreme caution when considering this platform.

FAQ

- Where is JDR Securities registered?

JDR Securities is registered in Australia (JDR Securities Australia Pty Ltd), New Zealand, and Saint Vincent and the Grenadines. - Is JDR Securities regulated?

JDR Securities operates under an Authorized Representative (AR) license from Royal Financial Trading Pty Ltd but is not directly regulated by the Australian Securities and Investments Commission (ASIC). - What types of trading accounts does JDR Securities offer?

JDR Securities offers Standard Accounts and Professional Accounts, with different spreads and commission structures. The Standard Account has no commission, while the Professional Account offers spreads from 0 pips. - What are the spreads and commissions for JDR Securities?

The Standard Account offers spreads starting from 1.0 pip with no commission. The Professional Account offers spreads from 0 pips, with a $7 commission per lot traded. - What leverage does JDR Securities provide?

JDR Securities offers leverage of up to 400:1. - What are the main risks of investing with JDR Securities?

The primary risks include lack of effective regulation, hidden trading costs, slippage, high leverage risks, and insufficient fund protection measures.