Established in 2018, Bost Forex is a Hong Kong-based forex broker. Despite having valid registration, its lack of clear regulatory information raises concerns about the safety of investor funds.

Background and Registration of Bost Forex

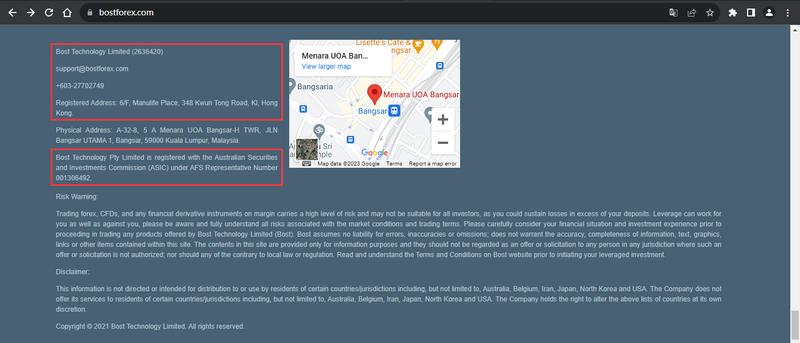

Bost Forex was founded in 2018, offering services in foreign exchange (forex), metals, energy, and indices. It is registered in Hong Kong, and its affiliate, Bost Technology Pty Limited, is registered in Australia. According to the Hong Kong Integrated Companies Registry Information System (ICRIS) and the Australian Securities and Investments Commission (ASIC), the registration details of both entities are verified and accurate. This means the company’s claims regarding its registration are true.

However, while these registration details may be accurate, that alone doesn’t guarantee the safety of operations or funds. In the financial industry, especially with forex brokers, having proper regulatory oversight in addition to valid registration is crucial to ensure investor protection and the fairness of trades. Although Bost Forex claims regulatory compliance, the situation is not as clear-cut.

Another concern is that Bost Forex’s website supports only English, which may limit the understanding of non-English speaking investors regarding its services and terms. Additionally, the company’s website lacks transparency in providing key operational and regulatory information, making it difficult for potential investors to get a complete picture of how their funds will be handled.

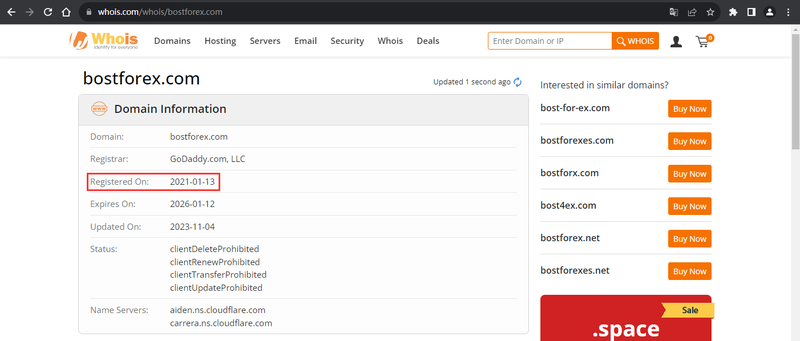

According to a Whois lookup, Bost Forex’s domain was registered on January 13, 2021, and has been active for more than two years. While the domain registration and basic details appear legitimate, the absence of clear regulatory information leaves significant doubts about the company’s legality and transparency.

Regulatory Status: Ambiguous Compliance and Potential Risks

In the financial industry, regulatory oversight is essential for ensuring that a broker is operating legally and safely. While Bost Forex claims on its website to be regulated by relevant Hong Kong authorities, further investigation reveals discrepancies. Checks with the Hong Kong Securities and Futures Commission (HKSFC) and the Hong Kong Monetary Authority (HKMA) show no records of Bost Forex being licensed by these agencies. This lack of proper regulatory status casts serious doubts on the company’s claims and raises concerns about the safety of funds entrusted to them.

1. The Issue with Bost Technology Pty Limited’s AR License

Bost Forex’s affiliate, Bost Technology Pty Limited, claims to hold an Australian Securities and Investments Commission (ASIC) Authorized Representative (AR) license. However, ASIC records show that Bost Technology Pty Limited is not a directly licensed entity. Instead, it operates under the AR license of another firm, MGF CAPITAL PTY LTD.

Bost Forex’s affiliate, Bost Technology Pty Limited, claims to hold an Australian Securities and Investments Commission (ASIC) Authorized Representative (AR) license. However, ASIC records show that Bost Technology Pty Limited is not a directly licensed entity. Instead, it operates under the AR license of another firm, MGF CAPITAL PTY LTD.

2. Weak Regulatory Oversight

The companies holding AR licenses are generally subject to less stringent oversight compared to firms with full licenses. This means that companies like Bost Technology Pty Limited, which operates under an AR license, may not offer the same level of security and protection as fully regulated firms. Additionally, the fact that MGF CAPITAL PTY LTD has sold AR licenses to over 20 entities weakens the overall trustworthiness of the companies operating under these licenses.

Given this information, it’s clear that Bost Forex’s regulatory claims are questionable. Without direct and full regulatory oversight, the risks associated with investing through this company increase significantly.

Risks and Investor Concerns Surrounding Bost Forex

In the financial industry, compliance is key to ensuring that investor funds are protected. With unclear regulatory information, Bost Forex may present significant risks to its users. The company’s operational model, heavily reliant on external AR licenses, brings its transparency and legitimacy into question.

Case Study 1: Financial Firm Using External Licenses

In 2018, a European forex broker, XYZ Markets Ltd, expanded its operations by purchasing third-party AR licenses. While the firm quickly grew across multiple countries, it faced numerous complaints from clients about delayed fund withdrawals within two years of operation. Despite claims of being regulated locally, it turned out that XYZ Markets Ltd was only using an external license for promotional purposes, leading to weakened regulatory oversight. When market conditions worsened, XYZ Markets Ltd failed to honor client withdrawals, ultimately leading to its bankruptcy.

This case demonstrates that firms like Bost Forex, which depend on external AR licenses, may appear compliant but often lack the financial security and investor protection needed. In times of market volatility, companies with only AR licenses might not have the capability to safeguard investor funds.

Case Study 2: Misleading Regulation in Asia

Another notable case occurred in Asia, where a forex broker named Delta FX claimed to be regulated by authorities in Hong Kong, the UK, and Australia. However, investigations revealed that the firm held no direct regulatory licenses in any of these regions and was instead relying on third-party licenses. When market conditions fluctuated, Delta FX struggled with liquidity issues and ultimately froze many client accounts. The company’s inability to honor withdrawals resulted in significant financial losses for its clients.

This situation is similar to Bost Forex, which, despite being registered in Hong Kong and Australia, relies on external AR licenses. Investors working with such companies face heightened risks regarding the safety of their funds.

How Investors Can Identify and Avoid Risks from Unclear Regulatory Status

When dealing with companies like Bost Forex, investors need to be cautious. Here are some strategies to help mitigate risks:

1. Verify Regulatory Information

Before committing funds to any broker, always verify the company’s regulatory status directly through official websites like HKSFC or ASIC. Although Bost Forex claims regulatory status, investors should double-check whether those claims are valid.

2. Be Wary of AR Licenses

Operating under an AR license is a common business practice but does not equate to full regulatory oversight. Investors should be cautious of companies relying on AR licenses and should consider firms that hold full regulatory licenses instead.

3. Demand Transparency in Fund Management

A reliable financial service provider will offer transparent information about how client funds are managed. Bost Forex’s website lacks transparency regarding how it safeguards client money. Investors should prioritize companies that regularly publish financial reports and regulatory documents.

4. Consult a Financial Advisor

If you’re uncertain about a company’s regulatory standing, consider consulting with a professional financial advisor. Advisors can help evaluate the legitimacy of a forex broker and assess whether it’s suitable for your investment needs.

Frequently Asked Questions (FAQ)

- Is Bost Forex regulated by the Hong Kong Securities and Futures Commission (HKSFC)?

No, there is no evidence to suggest that Bost Forex is regulated by the HKSFC. Official searches indicate no regulatory connection between Bost Forex and HKSFC. - Are funds with Bost Forex safe?

Due to the lack of clear regulatory information and reliance on third-party AR licenses, the safety of funds with Bost Forex is questionable, and there are potential risks involved. - Is the AR license of Bost Technology Pty Limited valid?

Bost Technology Pty Limited holds an AR license under MGF CAPITAL PTY LTD, but this type of license offers limited protections and is not equivalent to a full financial license. - How can I verify if a forex broker is reliable?

Always check if the broker holds a full license from a recognized regulatory body, look into their operational history, financial transparency, and review customer feedback. - What is the relationship between Bost Forex and Bost Technology Pty Limited?

Bost Forex is linked to Bost Technology Pty Limited, which operates under MGF CAPITAL PTY LTD’s AR license. However, there is no direct regulatory relationship between them. - How can investors avoid similar risks?

Investors should choose fully licensed brokers, avoid companies with unclear regulatory information, and verify any claims through official channels before investing.